Most firms have established their business models based on an evolutionary process that took years to develop. Procedures and policies are created in response to market conditions, the needs of shareholders and economic cycles of boom-and-bust. This is true for virtually every market sector be it retail, insurance, healthcare, transportation or finance.

In recent years, however, technology and particularly the internet has caused significant disruption in these market sectors, moving many businesses online in order to continue to exist. The willingness and ability of businesses to discard established procedures and rapidly adapt to technological innovation and market demands for flexibility, speed, and customer convenience has become a matter of survival in an increasingly competitive global market.

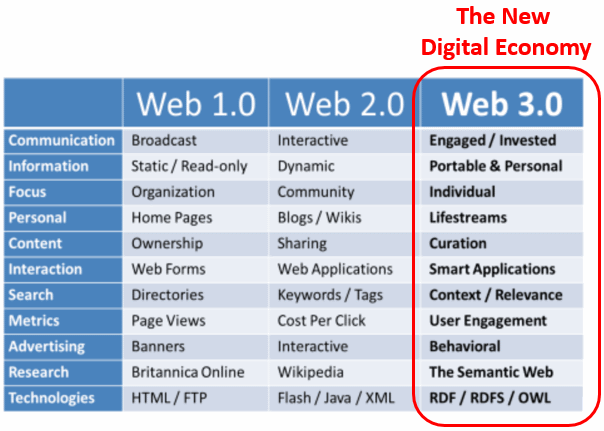

As we enter the era of “Web 3.0”, a phase where the internet expands beyond online shopping, media sharing and social networking, new business models are emerging that are leveraging the internet with mobile communications, cloud computing, AI, and blockchain technologies. Web services will become more personal, interconnected, distributed, secure and tailored to the individual.

Established firms as well as countless startups are already developing the new products and services which will leverage the features of “Web 3.0”. As diverse as these businesses in the “New Digital Economy” will be, the one thing that they will all need to innovate and grow is basic corporate banking services.

Unlike other sectors where the ability to rapidly shed old business processes to adapt to new technologies is a competitive advantage, the finance sector has had to deal with the flip-side of the coin; whether to even offer financial services to new technology start-ups where business models are new, unfamiliar, and unprecedented. In the shadow of the dot-com boom and bust during the early 2000’s, followed by the global financial crisis of 2008, over the past decade banks have adopted drastic measures to avoid risk.

Typical questions that traditional banks ask new corporate clients include:

- Does your firm have a solid 5-year credit history?

Most firms in the New Digital Economy are startups or post-startups with less than 3 years of credit history, if at all. - Does your firm belong to an industry sector that can be benchmarked?

New technology firms are often pioneering new business models where no precedence in traditional market sectors exist - Are your current revenues at least 10 million dollars a year?

New tech startups seldom have this level of income for several years — in the case of AirBnB it took 8 years to reach profitability; growth was prioritised over profits because critical mass was required for mass adoption of their services.

In a time where the ability to adapt new technologies and business models has become a key to success for most businesses, most banks have gone in the other direction; minimising risk and serving traditional and established businesses takes precedence over dealing with new, innovative firms. This resistance to providing banking services to non-traditional businesses is having a dampening effect on the growth of firms participating in the “New Digital Economy”.

The time is ripe for a “clean-slate” in financial services

As a sector that is particularly resistant to change, the question that arises is whether large, established financial institutions with thousands of employees and shareholders are even able to adapt to markets which are changing at the fastest pace in history. Business inertia, legacy monetary policies and conservative shareholders have become barriers to innovation.

Given the history, size and resistance to change of the large traditional banks of today, addressing the banking requirements of the next wave of companies in the New Digital Economy requires a different approach; a new breed of bank that focuses on the needs of the non-traditional innovators and startups of today. A bank that can focus on the future without the legacy of the past.

As a sector that is particularly resistant to change, the question that arises is whether large, established financial institutions with thousands of employees and shareholders are even able to adapt to markets which are changing at the fastest pace in history. Business inertia, legacy monetary policies and conservative shareholders have become barriers to innovation.

Given the history, size and resistance to change of the large traditional banks of today, addressing the banking requirements of the next wave of companies in the New Digital Economy requires a different approach; a new breed of bank that focuses on the needs of the non-traditional innovators and startups of today. A bank that can focus on the future without the legacy of the past.

The Initium Group: serving the New Digital Economy with a Clean-Slate

Founded by a seasoned banking veteran Daniel Spier, the INITIUM Group is focusing on precisely this sector. By providing basic corporate banking services to the underbanked innovators of today, INITIUM will provide promising firms in the New Digital Economy with the crucial banking services they need to grow their businesses across multiple jurisdictions; corporate accounts, card issuing and acquiring, clearing and liquidity services — quickly and unbureaucratically.

As opposed to being a competitor to the established banks of today, INITIUM is addressing precisely the sectors which are being either left on the table, or are being pushed out due to increasing regulatory pressures. INITIUM will take the time to understand and serve the players in the New Digital Economy, a niche that large traditional banks are not interested in serving.